tax is theft australia

Among the most egregious examples this year another Australian was fleeced 181000 via a dating website. An Act to amend the Criminal Code Act 1995 and for other purposes Assented to 24 November 2000The Parliament of Australia enacts.

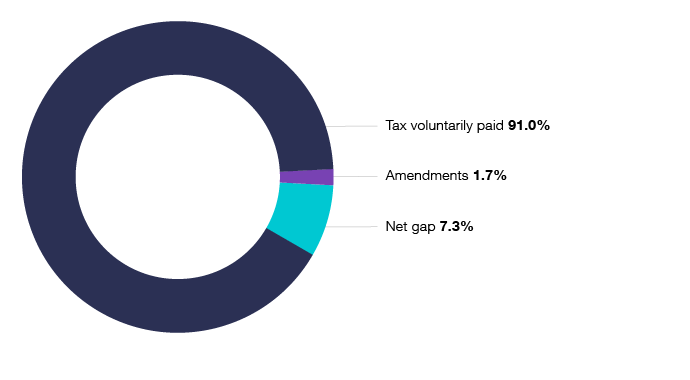

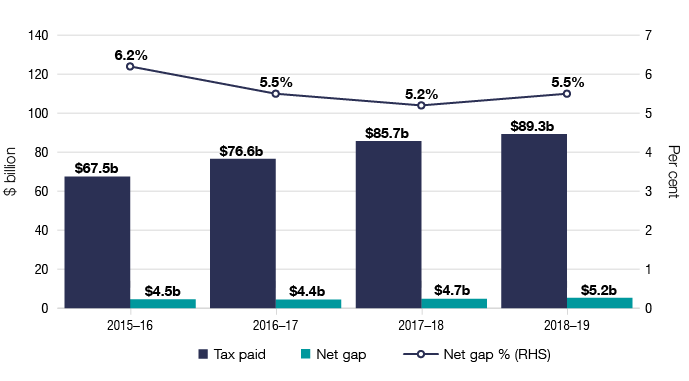

Tax Gap Program Summary Findings Australian Taxation Office

Over a period of about 73 days in 2012 Ms Marshall loaned.

. Section 25-45 of the Act allows a deduction for a loss by theft stealing embezzlement larceny defalcation or misappropriation by an employee or agent other than. After 7-Eleven was found to be systemically underpaying its. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Identity crime is a critical threat to the Australian community. You can no longer claim theft losses on a tax return unless the loss is attributable to a federally declared disaster. Ben Renshaw Partner People Advisory Global Expatriate Services Employment Taxes.

Income taxes are the most significant form of taxation in Australia and collected by the federal government through the Australian Taxation OfficeAustralian GST revenue is collected by the. Tasmania Police arrested and charged James Burrows after an 18-month long joint investigation with the Australian Tax Office ATO that was sparked by complaints on. If you are behind on taxes even just 10 behind 11 states allow.

This deduction has been suspended until at. In most cases your employer will deduct the income tax. The tax laws authorise us to impose administrative penalties for conduct such as.

If you have problems opening the pdf document. Failing to lodge a. Im surprised how common this kind of government home theft is.

1 Short title This Act may be cited as the Criminal. Country status and Australian domestic implementation for Australian tax treaties is available. This crime type generates significant profits for offenders and causes considerable financial losses to the Australian.

23 hours agoNeither would agree to talk to me. Wage theft is distinct from the problems involved in casual and insecure work the gig economy and tribunal decisions to reduce penalty rates because it involves unlawful. It marks a significant departure from conservatism and.

Introduced last year the Victorian Wage Theft Act 2020 will make wage theft a criminal offense when it comes into effect which will be no later than 1 July 2021. Making a false or misleading statement or taking a position that is not reasonably arguable. 29 September 2021.

On one hand countries such as Singapore have relatively low tax rates with Income Tax capped at 22 for every. There has been a significant increase in tax-related scams fraud attempts deceptive emails and SMS schemes targeting Australians. They can create fake identity documents in your name get.

Passport tax file number licence Medicare or other personal identification. March 28 2019. Business owners who cheat tax laws will face massively higher penalties as the Berejiklian government moves to raise fines to more than 100000 to crack down on wage theft.

Each country has a differing view and approach to this. The main offences for prosecuting tax fraud also known as tax evasion are contained in sections 1341 1 1342 1 and 1354 3 of the Criminal Code Act the Act all of. Thieves only need some basic details such as name date.

Wage theft is the practice of paying workers less than they are entitled to under Australias workplace relations system 1. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. The position that taxation is theft and therefore immoral is found in a number of political philosophies considered radical.

On 4 October 2019 Ryan McCarthy 27 was sentenced in the Brisbane District Court to 5 years imprisonment with a non-parole period of 18 months for placing false job. Those who commit offense. Most commonly wage theft will involve an employer.

Australia - Tax Treaty Documents. Identity theft is when a cybercriminal gains access to your personal information to steal money or gain other benefits. Identity theft is a type of fraud that involves using someone elses identity to steal money or gain other benefits.

Tax Gap Program Summary Findings Australian Taxation Office

Why Some Corporations Pay No Tax Australian Taxation Office

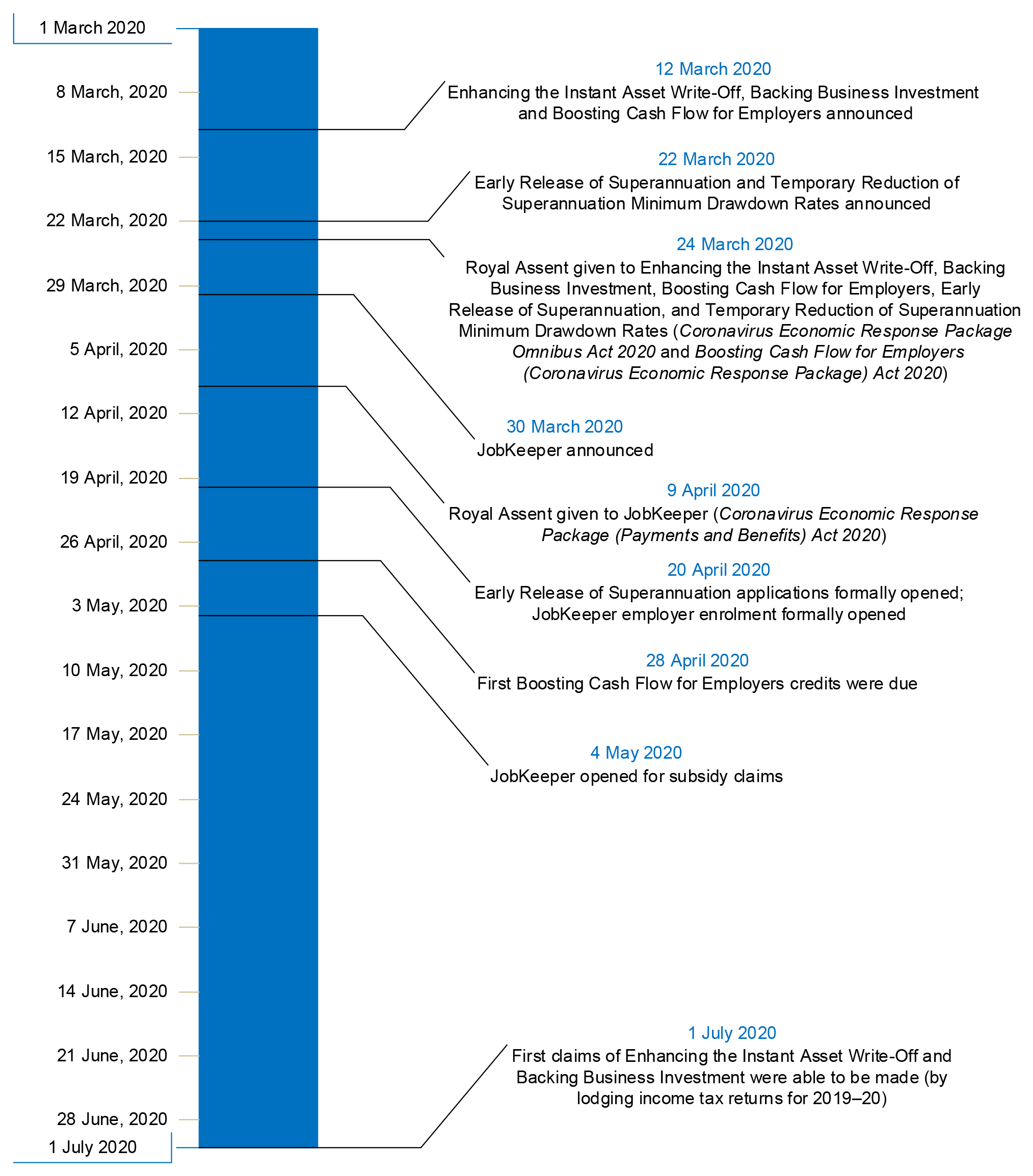

The Australian Taxation Office S Management Of Risks Related To The Rapid Implementation Of Covid 19 Economic Response Measures Australian National Audit Office

Cost Of Tax Compliance Australian Taxation Office

Do You Pay Tax On Lost Stolen Or Hacked Crypto Koinly

The Performance Of The Tax System Australian Taxation Office

Australian Taxation Office Phone Scam Alert Scammers Pretending To Be From The Ato Are Using A New Tactic They Ll Phone You About A Fake Tax Debt And Try To

Pdf Tax Related Behaviours Beliefs Attitudes And Values And Taxpayer Compliance In Australia

Crypto Tax In Australia The Definitive 2021 2022 Guide

Pdf Tax Related Behaviours Beliefs Attitudes And Values And Taxpayer Compliance In Australia

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

Australia Theft Rate Data Chart Theglobaleconomy Com

Tax Gap Program Summary Findings Australian Taxation Office

Joint Chiefs Of Global Tax Enforcement Australian Taxation Office

Is Taxation By Definition A Form Of Theft Why Or Why Not Quora